Press Report

Join us as we explore the headlines, delve into the issues, and uncover the stories that matter most. With Press Report, you’ll always be in the know. Welcome aboard.

About

Services

Journalistic Excellence

Press Report traces its origins back to a vision of creating a digital news platform that transcends traditional boundaries.

Press Report: A Beacon of Trust

Building Trust Through Transparency

Navigating Misinformation

BLOG

Career Opportunities in Picture Making

Picture making is one of the prestigious branches of visual arts. There are countless career or job avenues that are readily available in the field of picture making. All these career opportunities provide numerous financial gains that can help learners cater for...

Build Corporate Culture on Solid Business Ethics by Avoiding Failure Platitudes

Introduction: Organizational challenges and problems are often glossed over in superficial generalising terms, which are identified as "Failure Platitudes". By breaking this damaging tendency, strong guiding values can be brought into play through decisive and...

4 Employee Documentation Mistakes

We've all been there. An issue with an employee comes up. It looks like its time to either do some corrective action or maybe even termination. What is the first question asked? "Did you document?" Documentation is much easier said than done. We all have good...

How to master technical analysis for better options trading skills

Options trading is becoming increasingly popular, and mastering technical analysis can significantly improve your options trading skills. Technical analysis involves studying past market data to predict future price movements, and understanding how to use this...

Choosing the Best Trading Platform for Your Needs: A Comprehensive Guide

When it comes to trading, choosing the right platform can make all the difference in achieving success. With so many platforms available, how do you know which one is the best for your investment needs? In this comprehensive guide, we'll outline all the important...

The Benefits of Hiring a Project Management Consultant

There are several benefits to hiring a project management consultant to assist you with your projects. These include having a reliable person fill in the skills gap and providing project reports on time. Filling in the expertise gap There are two options available if...

Jobs For Felons, Federal Government Issuing Licenses to Felons in the Auto Transport Industry

Jobs for felons are always hard to find and as most felons looking for a job know, any job or business that requires a license is usually a waste of time to try and apply for or try to start. Well I've found one profession that will give you a license, assuming you...

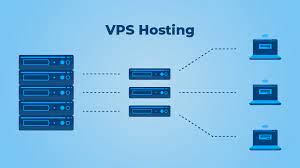

What are the Pros and Cons of Using cPanel on VPS?

When it comes to Virtual Private Server, Web Hosting companies in India offer various control panel options. And undoubtedly, the cPanel is one of the most popular choices when using it with India VPS. As cPanel offers a user-friendly interface that simplifies...

Importance of Ethics in Public Speaking

It is a known fact that the goal of public speaking is to gain a desired response from listeners but not at any cost, but we have to look into the branch of philosophy that deals with issues of right and wrong in human affairs "Ethics" Question of ethics arise...